option to tax form uk

During the early stages of COVID-19 we allowed businesses or agents to notify an option to tax with. Register for VAT if supplying goods under certain directives.

Does Hmrc Automatically Refund A Claim When You Have Overpaid Tax In The Uk Freshbooks

You can opt to tax one.

. In order to recover the VAT on the costs of. Opting to tax is quite easy. You can email notifications to optiontotaxnationalunithmrcgovuk.

Send this form to. There are 2 ways to do a Self Assessment tax return. If you do opt to tax you will need to charge the tenant VAT.

Generally the option to tax relates to discrete parcels of land andor specific buildings. However when you opt to tax you can get your cash back. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on.

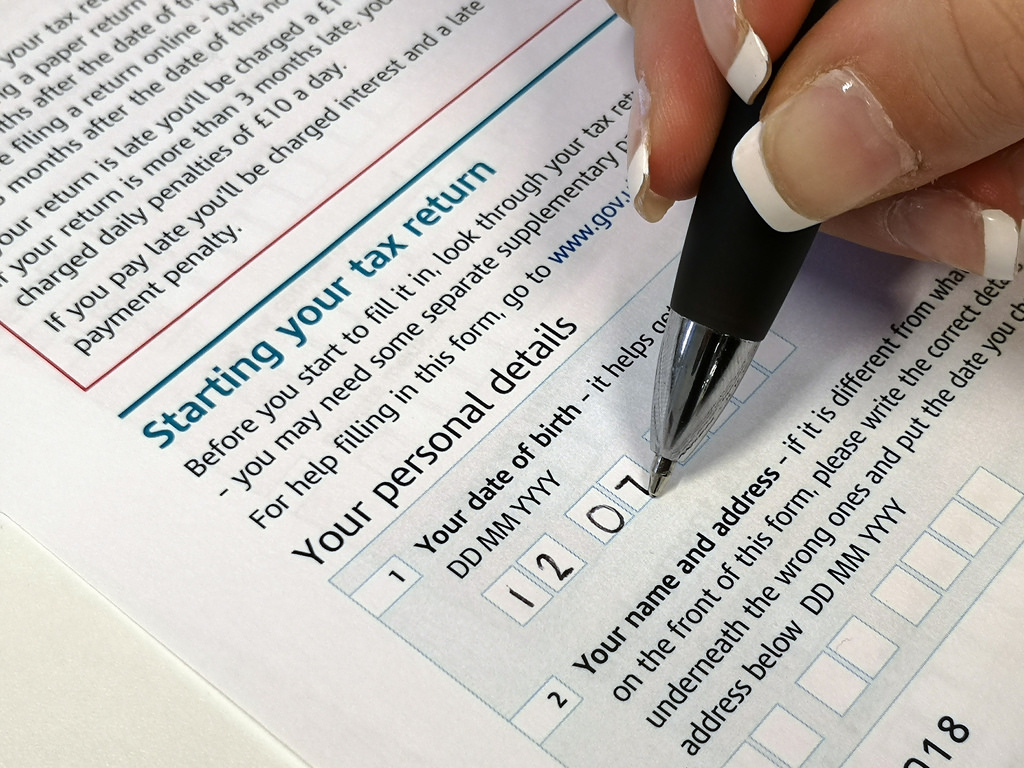

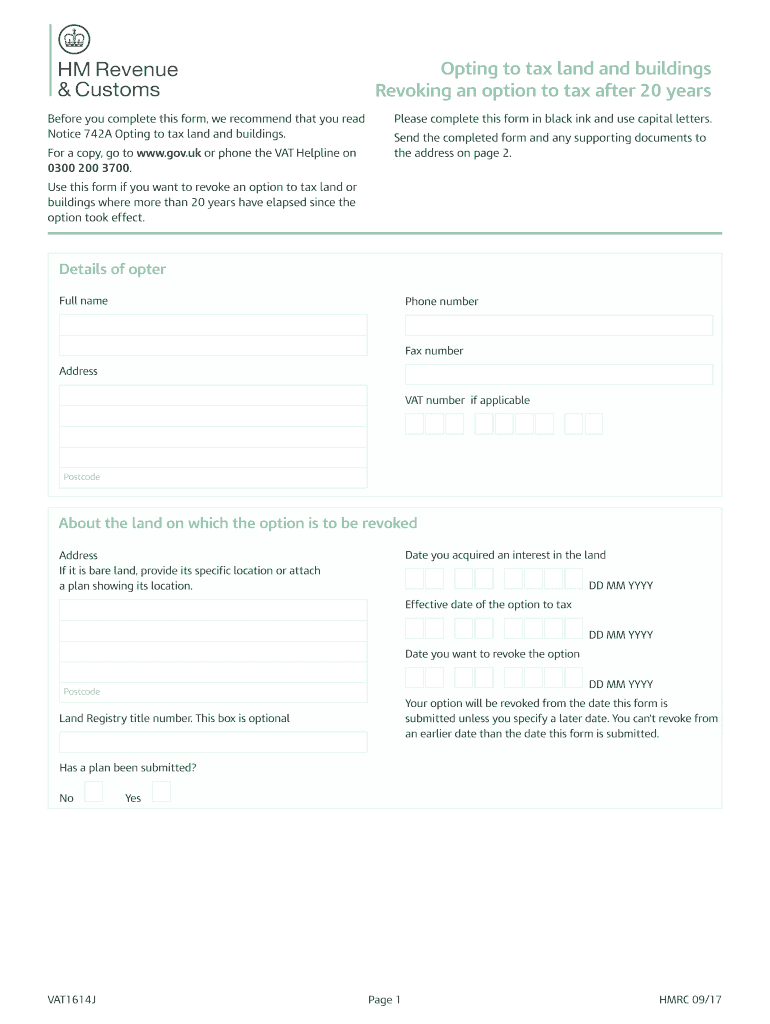

Choosing the correct formIf your business buys or rents out a non-residential property you may want to make an option to tax election to save VAT. File your Self Assessment tax return online download and fill in form SA100 This guide is also available in Welsh Cymraeg. Beforeyou complete this form we recommendthat you read VATNotice 742A Opting to tax land and buildings goto wwwgovukand search for VAT Notice 742A.

Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are. You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made Obtaining permission from.

However the ability to sign these forms electronically has been made permanent. Download and fill in form. Tell HMRC about an option to tax land and buildings 4 March 2022 Form Stop being a relevant associate to an option to tax 15 May 2020 Form Revoke an option to tax for.

Provide partnership details when you register for VAT. The option to tax form can be found on HMRCs website and can be submitted with an electronic signature but HMRC has suggested that it will also require evidence that the. UK Property Accountants is a leading.

In fact you may also be able to claim ongoing expenses and other. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord. The case involved the.

Opting to tax is quite easy. The time limit for notifying an option to tax has returned to 30 days from 1 August 2021. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made.

Option to tax.

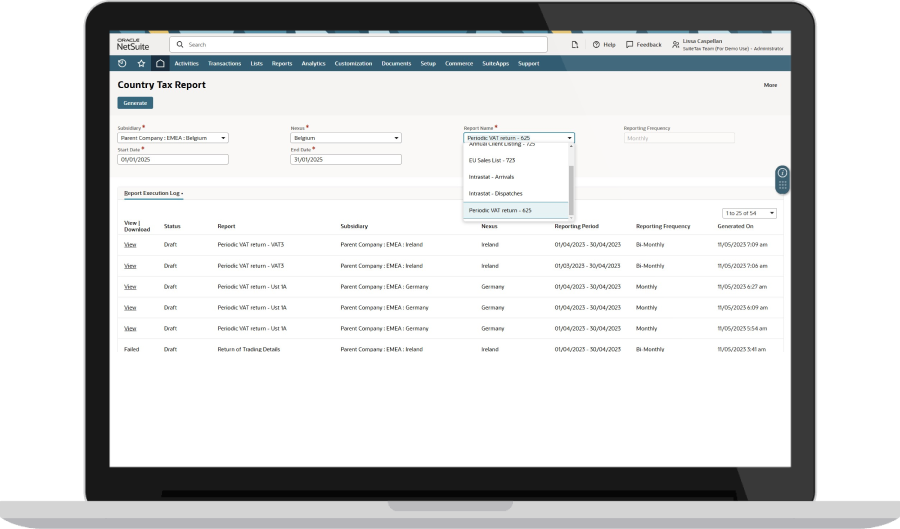

Netsuite Tax Management Software

Making Tax Digital Vat Form 100

Tax Form Uk Hi Res Stock Photography And Images Alamy

Fill Free Fillable Forms London Institute Of Management And Technology

Old Vs New Tax Regime Which One Should You Choose Forbes Advisor India

Form 10ie To Opt For New Tax Regime Financepost

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax

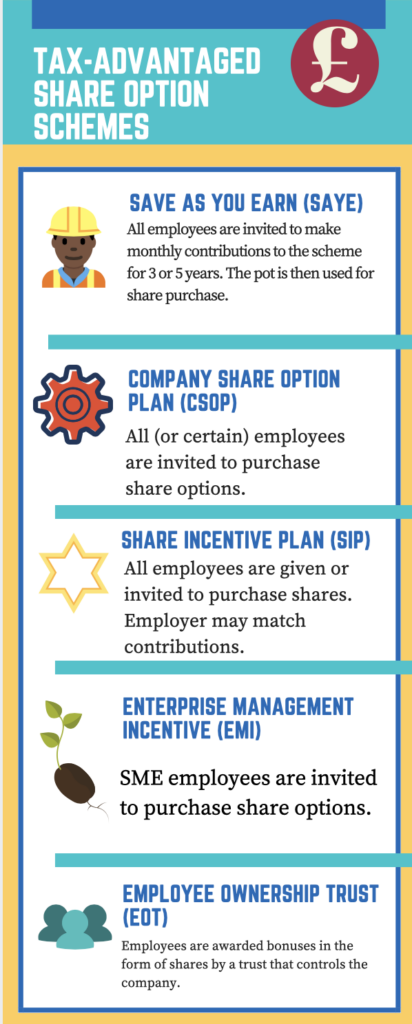

A Guide To Employee Share Schemes Advice Harper James

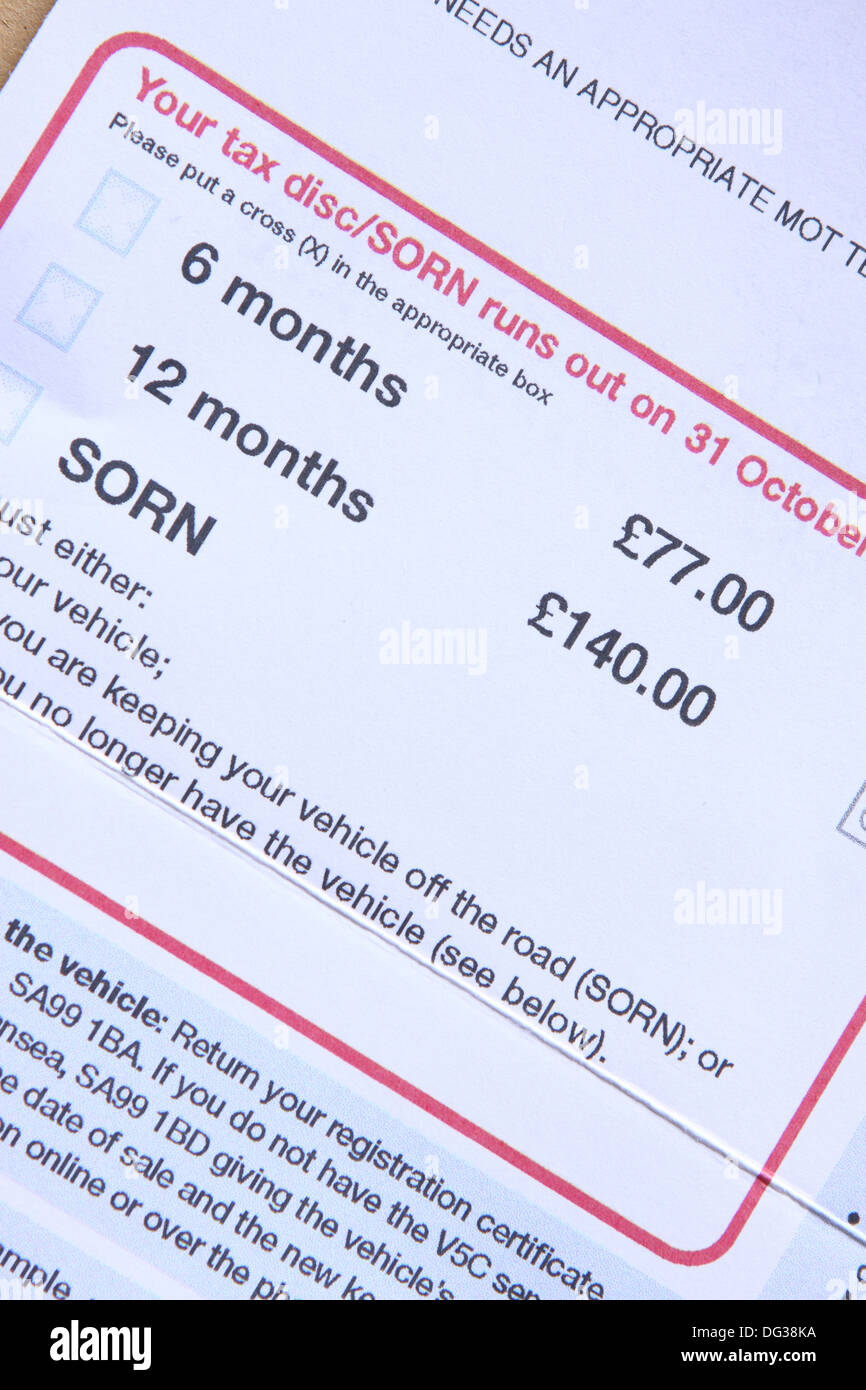

Statutory Off Road Notification Hi Res Stock Photography And Images Alamy

Hmrc Errors And Mistakes Guidance How To Amend A Tax Return

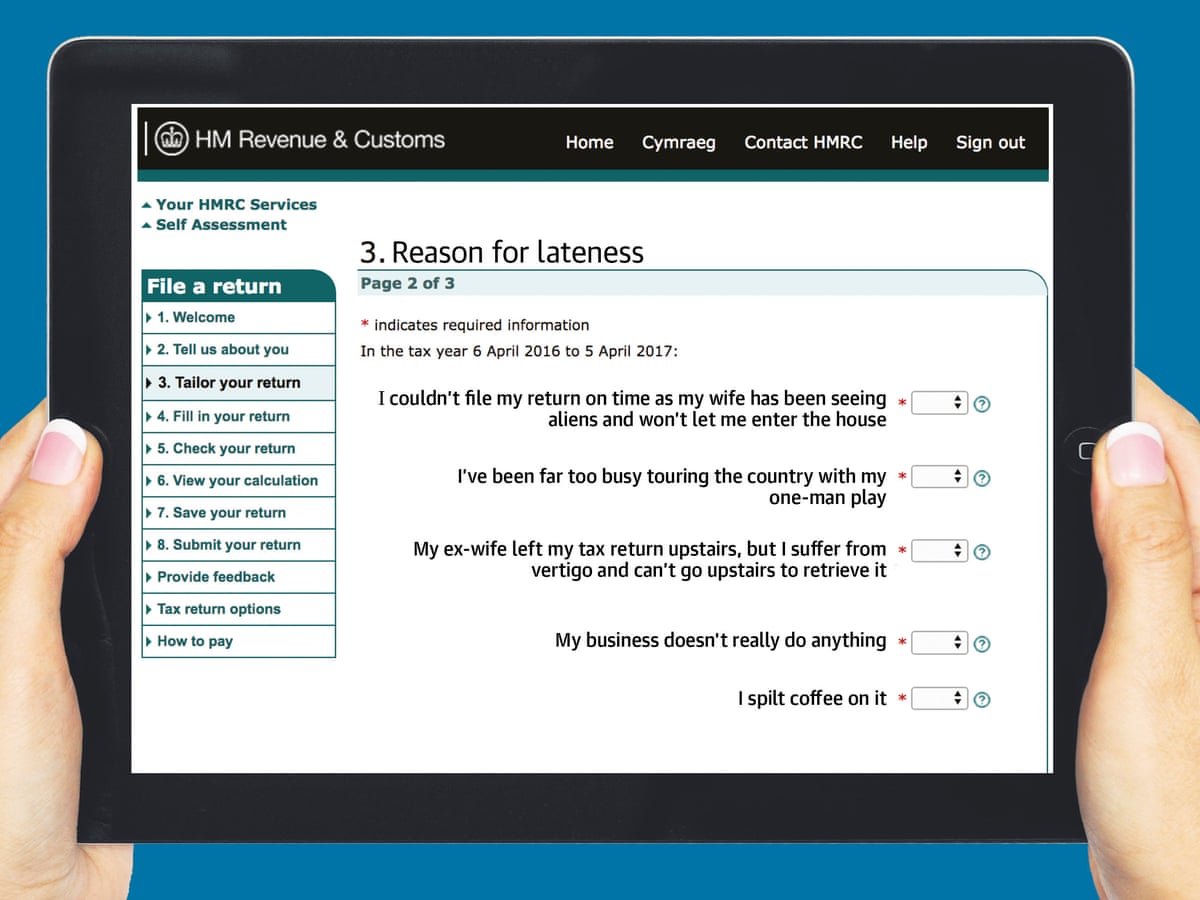

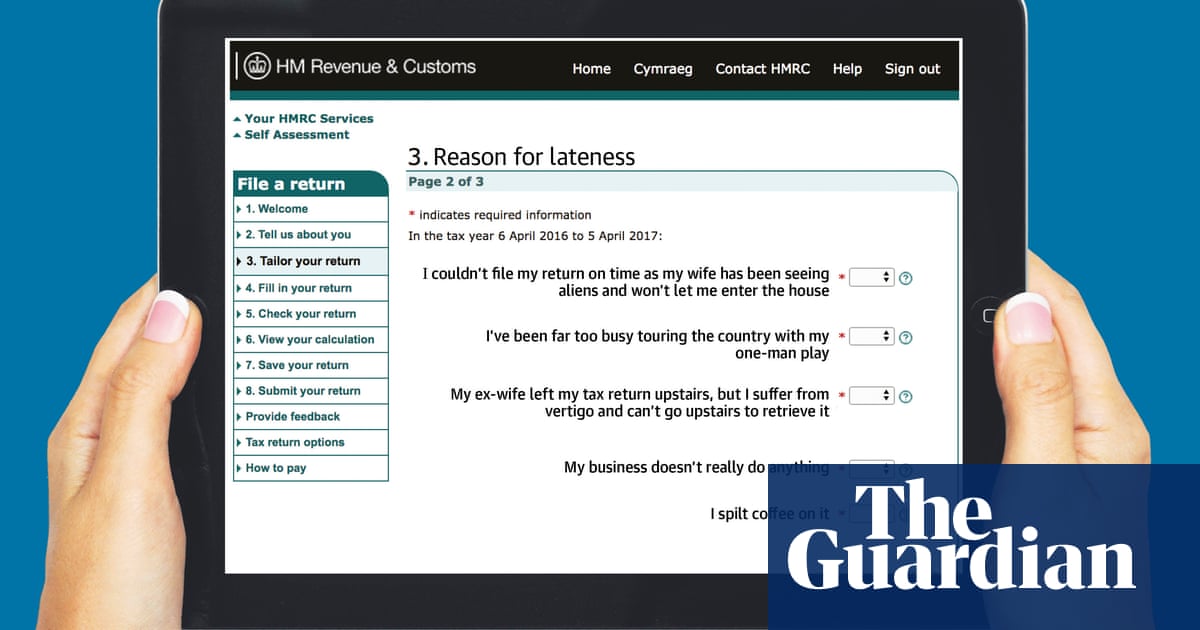

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

Best Tax Software Of October 2022 Forbes Advisor

Portfolio Management Timetotrade

Can You Amend Your Self Assessment Tax Return Once It Has Been Filed

International Student Tax Return And Refund

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Vat1614a Fill Out Sign Online Dochub

Need To Do A Tax Return For The First Time Tell Hmrc By 5 October Gov Uk

What Is Irs Form 1040 Overview And Instructions Bench Accounting